Simplified tax matching

The Axtension® Invoice processing solution offers two options when matching and validating invoices with tax rates and tax amounts. These two options are: enabled simplified tax matching or disabled simplified tax matching. Which option is used depends on the following criteria:

- The tax information available in Dynamics365

- The tax information used on the purchase order header or purchase order line(s)

- The tax information available on the invoice

Simplified tax matching - enabled

When working with purchase order invoices, without using the invoice register (or posting tax in your approval journal), simplified tax matching can be applied. In other words, the tax matching from a purchase order invoice against a purchase order can be simplified.

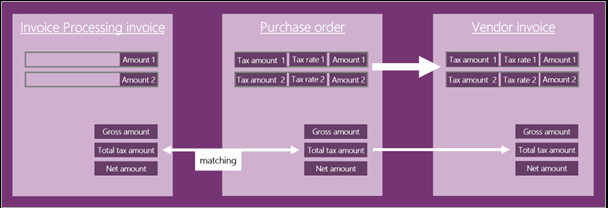

When simplified tax matching is enabled, the gross amount, total tax amount and net amount needs to be imported from the purchase order invoice, the tax rate can be imported, but is not required. The total tax amount from the purchase order invoice is compared and validated against the total tax amount on the purchase order. This way, the full tax breakdown from the purchase order invoice doesn’t need to be imported. This is possible since your item sales tax group and sales tax group already has been defined on the purchase order lines or on the purchase order header.

The image below is a visual representation of the simplified tax matching process. From the purchase order invoice the total tax amount is matched and validated against the total tax amount from the purchase order. When the total tax amount is matching, the tax rate(s) and tax amount(s) from the purchase order header or purchase order lines are used on the vendor invoice.

Simplified tax matching - disabled

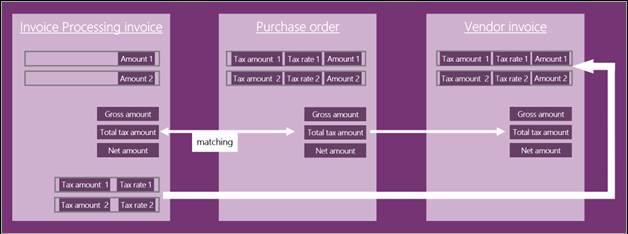

The image below is a visual representation where simplified tax matching is disabled. On the purchase order invoice the gross amount, total tax amount, net amount and the tax breakdown are available. This means that multiple tax rates with the associated tax amounts are available on the purchase order invoice. In this scenario the total tax amount between the purchase order invoice and purchase order are matched and validated. If the matching of the total tax amount is successful, the tax breakdown from the purchase order invoice is used on the vendor invoice for processing.

A simple rule

To determine if the simplified tax matching option needs to be used a simple rule can be applied. If the tax information is used from the purchase order, simplified tax matching needs to be enabled. If the tax information from the invoice is used, simplified tax matching needs to be disabled.

Scenario 1: Simplified tax matching - enabled

In this scenario the use of simplified tax matching is explained.

The purchase order

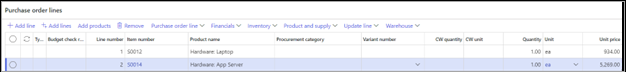

A purchase order is created with two purchase order lines. The item numbers S0012 and S0014 have been added with a Quantity of 1 and the Unit price is displayed.

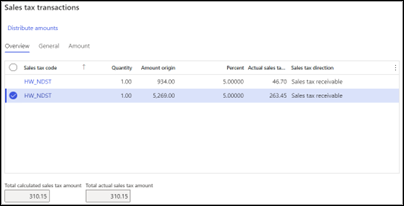

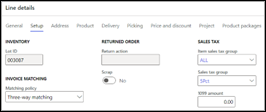

| On the Line details section the Item sales tax group and Sales tax group are added to apply the correct tax rate. For the purchase order the sales tax can be displayed. The amount, tax rate and tax amount are displayed per purchase order line. The sales tax can be found in the menu Purchase → Tax → Sales tax. |  |